Tokenomics & Features

Summary

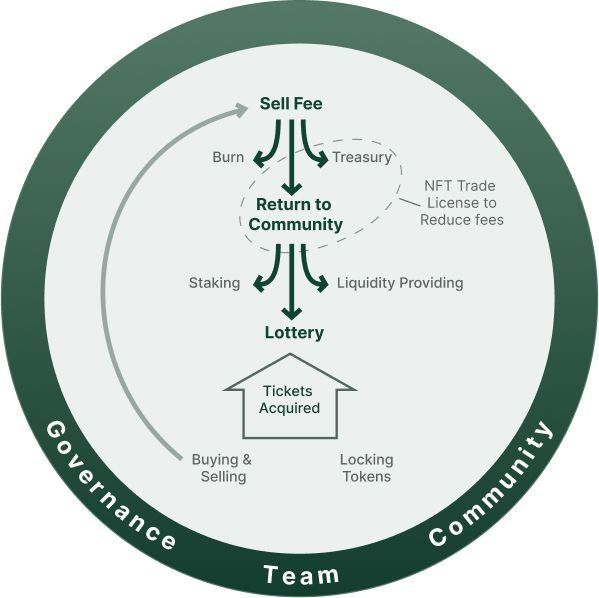

Elevault's design begins with a refined version of the tried-and-true sale fee of 6%, where 1% is earmarked for burning and 5% is redistributed. The 5% levy is divided among several pools, including the protocol treasury, staking/LP rewards, and the Elevault lottery rewards pool. Notably, users can eliminate the 5% sale fee by purchasing and binding a Trade License NFT to their wallets. The lottery will award a winner weekly and investors earn tickets (or entries) through trading volume or token locking. Elevault is a deflationary token as no new tokens will be minted after the initial mint. The small burn on each transaction drives deflation, while the reward structure incentivizes trading resulting in continued burn. Elevault's framework is fortified by robust supporting components, underpinning security, governance, and community-driven evolution. The protocol has strict limits to variable adjustments post-launch and will transition to community governance shortly post-launch. This adaptive approach provides flexibility in the short term while fostering community control in the long run. Moreover, ongoing team support for development, community management, and strategic initiatives is sustained by funds from the treasury portion of the sale fee. Additionally, token allocation and vesting schedules have been carefully designed to effectively incentivize the team while prioritizing the community's security and the longevity of the project.

Sale Fee Details

In every transaction involving the sale of Elevault tokens, a 6% sale fee is imposed. 1% of the transaction volume is burned as a deflationary mechanism. Additionally, 5% of tokens are taken and allocated to the protocol treasury (20%), the lottery rewards pool (40%), and the staking/LP rewards pool (40%). All fee proportions are provisional and subject to modification via limited changes upon launch and on-chain governance in the future. Strict limits on fees and allocations have been put in place so that no amount can more than double or decrease to less than half before on-chain governance.

Sell transactions can be exempt from the 5% fee by traders acquiring an NFT Trade License issued by the project and binding it in their respective wallets which takes two days to bind, and ten days to unbind. However, sales are still subject to the 1% fee that is burned.

The NFTs will be generated and sold by the team exclusively during the pre-sale and public sale phases, thereafter becoming tradable on the secondary market. There will be no additional issuances post-launch, no royalty fees for NFT transactions on the secondary market, and NFT leasing is on the roadmap for early addition.

Lottery Details

At the core of the project lies an innovative lottery mechanism designed to incentivize and reward users for their engagement in trading activities or for locking tokens. Each Sunday at 6PM ET there will be a lottery draw, offering participants the opportunity to claim the pot comprised of trading fees accumulated throughout the week.

Users can engage with the lottery through two distinct avenues:

- Trading: Users can accrue lottery tickets by trading Elevault tokens, with each 50 tokens of trading volume (both buying and selling) earning one lottery ticket for the period in which the trade occurred. Following each lottery draw, users' ticket count and the lottery reward pool reset to zero as that week’s winner is selected.

- Locking: Alternatively, users can opt for a more passive but highly rewarding approach by locking Elevault tokens for varying durations. Users choose the quantity of tokens and the duration of the lock-up(in number of lottery periods), resulting in the earning of lottery tickets (or entries) each week for each lottery occurring during the chosen lock-up period. Locking for 1 week earns 1 entry per 50 tokens locked, increasing by 1 entry per 50 tokens for each additional week locked. This means that 50 tokens locked for 2 weeks earns 2 entries each week and 100 tokens locked for 10 weeks earns 20 entries per week. The maximum lock length is 50 periods which results in a 1:1 ratio of entries per tokens locked each week. An additional example can be found on page 13.

Users can pursue one approach or a mixture of both to earn lottery tickets. While the current award system has been thoroughly modelled and tested, it might require optimization based on community behavior. As with the sale fee, ticket earning ratios can only be reduced by 50% or doubled until on-chain governance begins. Additionally, the foundation cannot earn lottery tickets as wallets holding treasury or community designated funds have been excluded.

Token Allocation & Vesting

Detailed breakdowns for token allocation and vesting can be found in the appendix on page 12. Elevault’s allocation and vesting have been carefully designed to effectively incentivize the team while prioritizing the community's security and the longevity of the project. Vesting follows the below breakdowns:

- Presale tokens vest monthly over 6 months starting immediately post-launch

- Founders/team tokens begin to vest after 3 months post-launch in the fourth month, and vest evenly over 12 months

- Community tokens vest monthly over 24 months starting immediately post launch and vest evenly over the 24 months

Staking & LP Details

Users have the additional option to stake Elevault tokens to earn staking rewards, which constitute a share of the generated trading fees (40% of the 5% fee). Individual staking rewards are proportional to the user's stake in the staking pool, with the flexibility to claim rewards or unstake at any time. There will be an approximately 24-hour unstaking period before tokens are available, where staking rewards are not earned.

Liquidity providers (LPs) play a pivotal role in any project featuring a tradable token, ensuring seamless trading operations with minimal slippage. Traditionally, LPs are compensated through fees levied by automated market makers, typically ranging between 0.05% and 0.3%. While the project is set up to provide some liquidity through initial funding and ongoing allocations, we will provide supplementary rewards to users to encourage additional liquidity providing.

To deliver these rewards, LPs have the ability to stake the LP tokens obtained from providing liquidity, thereby earning additional rewards proportionate to their staked token quantity. 10% of rewards allocated to staking will go to liquidity providers.

The security of this community is a high priority for the team. As mentioned throughout this section, team control upon launch will be restricted to enable adaptations necessary for Elevault to flourish, while protecting users from drastic changes. With on-chain governance arriving shortly post-launch these limitations will no longer apply once Elevault is under community stewardship.

Security & Governance

The security of this community is a high priority for the team. As mentioned throughout this section, team control upon launch will be restricted to enable adaptations necessary for Elevault to flourish, while protecting users from drastic changes. With on-chain governance arriving shortly post-launch these limitations will no longer apply once Elevault is under community stewardship.